We live in a predominantly credit driven world which makes having a low credit score or no credit score inconvenient when looking to rent or take out a loan.

What credit affects:

- Interest rates – even a small difference in interest rates can mean saving thousands of dollars over the period of the loan

- Access to better credit cards – good credit means accessing cards with lower interest rates, cash back, and travel points

- Insurance discounts – good credit can mean eligibility for lower insurance premiums

- Home options – good credit often means higher probability of being approved for an apartment rental, business rental and home rental

- It’s easier to be approved for a home mortgage with good credit!

- Security deposits – good credit can save a person money on their security deposit for rentals or have the deposit waived when setting up utility services

- Cell phone services may decide to extend or not extend your service with them based on your credit score

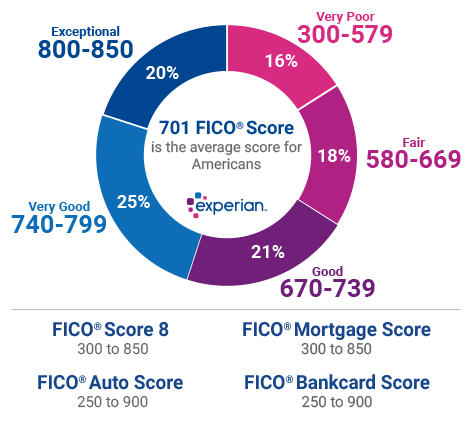

The FICO Score is most commonly used for determining credit score ranges:

- Exceptional: 800 and above

- Very Good: 740 to 799

- Good: 670 to 739

- Poor: 579 and below

How to improve your credit score:

- Pay your bills on time

- Past payment performance is a good indicator for future payment performance and lenders look at this pattern

- Pay off your debt

- Making minimum payments will extend how long you’re in debt and you’ll pay more in interest

- Maintain low balances on your credit cards

- Don’t close unused credit card accounts (unless they’re costing you money!)

- Check your credit report for inaccuracies

Everyone is eligible for a free credit report annually.

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)